On the Road to the Golden Age

We have previously discussed the inflationary period that defined the U.S. economy of the 1970s after gold was removed as the U.S. dollar backing, as well as how then Federal Reserve chairman, Paul Volcker, was able to stomp out inflation with equally dramatic interest rate hikes and the sheer impossibility for Jerome Powell and other central bankers to do the same today due to incomprehensible national debts. What we have not spoken about was the Gold Commission that was formed in 1981/82 by the administration of Ronald Reagan to investigate the role of gold within the monetary system to help ensure inflation experienced during the previous decade did not return. However, before breaking down the findings of the commission, it is important to take a look at the work done by a Swedish economist, Bertil Näslund.

In 1969, Näslund produced a theory called “On the Road to the Golden Age” that in short concluded, “It is shown that the Golden Age results are obtained as time approaches infinity.” Meaning, that for a country who is off a gold standard to return to some kind of sound money standard once again, the only way to do so is to run the money printers as hard as you can until time approaches infinity or in other words, the system completely crashes with gold then being used to pick up the pieces and return stability/faith in the money supply. So what did Reagan’s Gold Commission find? Well, the answer to that is two-fold as there was a majority report that was given, as well as a minority report that was later presented in the writings of Anna Schwartz. First off, the majority report concluded:

The majority of us at this time favour essentially no change in the present role of gold. Yet, we are not prepared to rule out that an enlarged role for gold may emerge at some future date.

If reasonable price stability and confidence in our currency are not restored in the years ahead, we believe that those who advocate an immediate return to gold will grow in numbers and political influence. If there is success in restoring price stability and confidence in our currency, tighter linkage of our monetary system to gold may well become supererogatory.

Think about what was just stated here. The majority of the commission agreed that there should be no change to the PRESENT role of gold (in the 1980s). That said, having not been prepared to rule out an enlarged role for gold in the future if price stability and confidence in the U.S. dollar was not restored. Fast-forward 40 years and it appears that price stability and confidence in the U.S. dollar has evaporated just as the world is beginning to talk a lot more about the shiny metals: silver and gold. What the minority report later stated is as follows:

The existence of a minority report was not revealed to the Gold Commission until a few days before the final revision of the Report that was intended to represent all views. The minority report was prepared under the direction of Congressman Ron Paul and mirrors his views rather than those of Lewis Lehrman who endorsed it. Paul proposed delay in the implementation of the program outlined therein until the Reagan Administration’s fiscal and monetary programs and the recommendations of the Gold Commission were given an opportunity to prove themselves.

Keeping in mind Bertil Näslund’s theory “On the Road to the Golden Age” that concluded a country off a gold standard to most suitably return back to a gold standard must first run the current un-backed fiat system into the ground destroying the currency in the process; ushering in gold. The minority report led by Congressman Ron Paul (who is still a leading advocate for sound money) suggested a delay in the implementation of a gold standard until the Reagan administration and the recommendations of the Gold Commission were given an opportunity to prove themselves. In other words, it was decided to continue to run the printers to INFINITY collapsing the system and proving you could not achieve price stability without sound money. With the plan set to run the un-backed fiat system to infinity, soaking up all the benefits of free money since 1981/82 before returning to a sound money standard with silver and gold – let us see what then happened:

That happened. Right after the Gold Commission report was submitted the U.S. spent more money than at any other time in history on any social program, military expansion, and Medicare package Congress could get their hands on. Now we find ourselves in a situation where the future the majority report warned about with price instability and massive loss of confidence in un-backed national currencies having arrived with the advocates for a return to sound money growing in number and political influence. The end game is known long before it arrives within the public consciousness and when it comes to total economic collapse due to the world reserve currency cratering in value – you do not want to be late in converting your wealth to sound assets. We will look back and realize they were doing us a favor by keeping precious metal prices so low this deep into an obvious inflation issue; allowing us to stack up and protect ourselves for cheap. Nothing lasts forever, and neither will this opportunity.

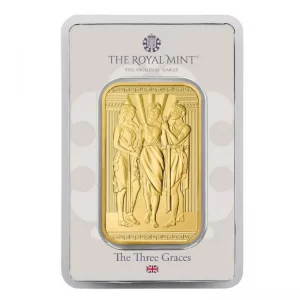

While the U.S. Mint continues to hemorrhage customers, the Royal Mint in the U.K. saw an 8% increase in gold sales and a 47% increase in silver sales over June (reporting many of these were Americans due to the U.S. Mint posting monumental premiums on 1oz American Silver Eagles). If you want to grab a limited edition bar out of the Royal Mint while you still can, check out the 1oz gold Three Graces Bar here.

Hi,

Hi,