Investors love gold. It’s an easy way to diversify your portfolio and safeguard against inflation. But with so many different types of gold bullion, how do you know which one is right for you? Fortunately, it’s easier than you think. Different gold bars have varying investment values. That’s because the price of each bar depends on many factors. For example, some bars are traded in large volumes and therefore have lower premiums over their intrinsic value (the metal they’re made from). Others are traded in smaller volumes, or not at all, making them more difficult to sell at a profit. This guide will help you choose the best gold bars for your investing needs. We cover everything from what type of investor should buy gold to how much an investment in gold bars is worth.

Best Investment Gold Bars

Important information about investing in gold bars

Gold bar investments have lower making fees and premiums:

It makes sense to invest in a gold bar because bars have a lower premium attached to them. Gold bars also have lower making charges and premiums involved. In addition to making charges, the premium you pay may also occasionally cover transportation and refining expenses. You get more for your money because economies of scale apply because gold bars are much larger in size.

Purchase options for gold bars in various weights:

Gold bars are available in weights ranging from ½ ounces up to 1000 ounces. bars being the most common sizes. It’s critical to consider your budget, investment objectives, and liquidity goals before making a choice. Higher-weight bars are less expensive to buy, but lighter bars are simpler to liquidate quickly.

Purity

If you are buying gold bars for investment purposes, purity is crucial. Be sure to purchase hallmarked or LBMA-certified bars. By doing this, you can be sure that you are getting your money’s worth and will be in a better position to sell your gold bar. Additionally, when making a purchase, you must insist on a purity certificate.

Where to purchase

To make sure you’re paying the lowest premium possible, it is worthwhile to visit a few trustworthy retailers before making your purchase. This is especially crucial when investing in gold bars because your investment is much larger.

Cons and benefits of purchasing gold bars

Gold bars are a better way to invest in gold for seasoned and large-scale investors. When compared to their smaller counterparts, these large bars are typically the most affordable. A drawback to purchasing large bars, though. These bars lack the smaller ones’ ability to be sold. This is because fewer buyers are available due to the larger size and consequently higher cost of large gold bars. When a gold bar or bullion owner tries to sell these items, there may be additional handling fees because bars are large pieces of gold that can be challenging to melt and reshape. Gold premiums are almost always rising, Likewise, their worth. The exact cost of these bars depends on several market variables that are active at any given time.

Motives for Purchasing Gold Bars

- Each year, central banks around the world make significant investments in gold, which is kept in the form of gold bars.

- Gold bars that have been refined require significantly less work, are much safer, and are simpler to stack inside a vault. The year, purity level, weight, and manufacturer’s logo are all imprinted on the front of gold bars, which are stamped in the shape of bricks or ingots.

- Gold bars are a better option for long-term investors who intend to hold their investments for a long time because they are less liquid.

What are the Best Brands of Gold bars To Buy?

Credit Suisse:

Credit Suisse is a very well-known brand for gold bars. The bank was among the first to provide retail gold bars to its customers, and it continues to lead the bullion bar market today. Credit Suisse has its headquarters in Switzerland. They are best known for their one- and ten-troy-ounce bars of 9999 fine gold as well as their gold bars in the “Liberty” style that come in 1, 2, and 20-gram weights, which surpasses IRA approval.

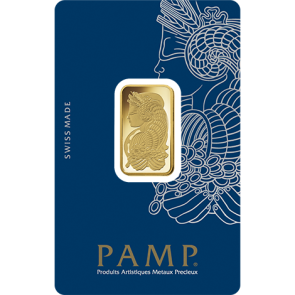

PAMP Suisse:

Another Switzerland based business with a long and illustrious history in the precious metal industry is PAMP Suisse. The PAMP Suisse Fortuna bars are arguably the most popular Gold bars in the entire world. They have received LBMA approval and have gold fineness levels of .9999. This business enjoys a similar level of worldwide respect and renown to Credit Suisse.

Perth Mint:

Australia’s renowned Perth Mint creates gold bars with weights ranging from 1/2 ounces up to 1000 ounces. These bars, which are all 9999 pure, were produced at one of the best refineries in the world. These bars are also available in 1-ounce and 10-ounce sizes. The bars are a very alluring option for those looking to invest because they have a tamper-proof display card and feature an image of a hopping kangaroo.

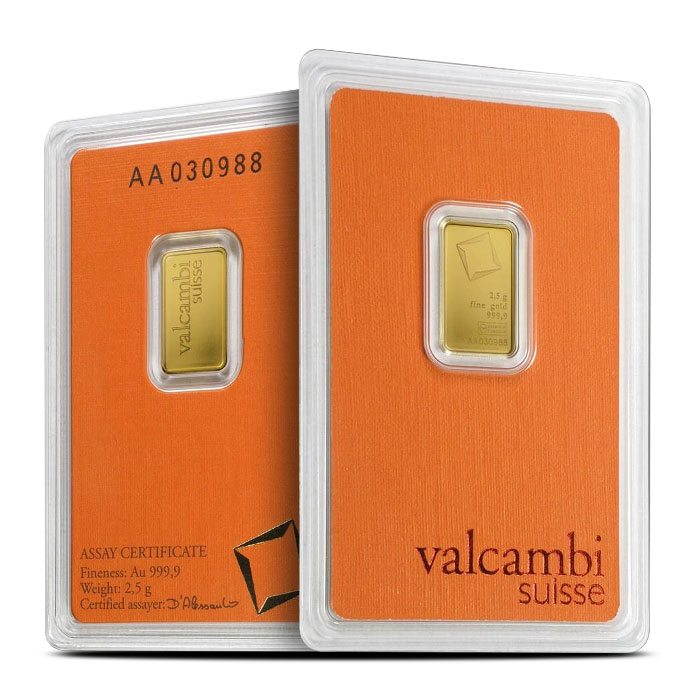

Valcambi CombiBar:

For more than 40 years, Valcambi has produced investment-grade bullion bars in gold, silver, platinum, and palladium. Investors looking for a truly distinctive gold bar design might want to think about the Valcambi CombiBar. There are 50 bars in each bar. As a result, they are 1 gramme each and very simple to disassemble. These bars have IRA approval and have a fineness level of.9999 gold.

The 50 g gold bar, which is designed to fit inside your wallet like a credit card, was first offered in 2011 by this Swiss company.

Royal Canadian Mint:

The Royal Canadian Mint has an illustrious history thanks to its service in the precious metals industry. They are renowned throughout the world for creating superior silver and gold bullion products. Their 1 Oz Gold bars are renowned worldwide and have a purity of .9999 Gold. Au Bullion is a proud authorized DNA dealer of the Royal Canadian Mint, you can find us on their list of trusted dealers!

Conclusion

Investors love gold. It’s an easy way to diversify your portfolio and safeguard against inflation. But with so many different types of gold bullion, how do you know which one is right for you? Fortunately, it’s easier than you think. The best gold bars for investors revolve around investment-grade gold bars and collectible gold bars.

Hi,

Hi,