It goes without saying that the world has vastly changed since 1642 when the Commonwealth of England was established and the Monarch took control. While their family assets date in some accounts to as far back as the 1300s it can be debated how much real power the Monarch still holds, as officially they wield no political power, however, with great wealth comes great influence, and it is clear the British Royal Family still possesses incredible wealth.

One way they have been able to preserve such status while officially holding far less power than they have in the past is through a deal that was passed in 1993. Queen Elizabeth II and Prince Charles signed a deal with then-Prime Minister John Major that allowed for the Monarchy to avoid the 40% inheritance tax that other citizens in the UK must pay on their assets once they pass away. For the newly crowned King Charles – this will save him a FORTUNE as the official holdings of Queen Elizabeth II are in the hundreds of millions, with the unofficial in the billions. This agreement is now being called into question as the United Kingdom faces an energy crisis and that 40% tax collection would have been able to subsidize some help. We should note this newsletter is not to debate whether the agreement is right or wrong, but rather to explore why the agreement was struck in the first place and how you too can begin building generational wealth. Ultimately, this deal helped preserved the wealth of the Monarch, protecting it from erosion each time someone in the family passed – thus allowing for a standard of living to also be passed down to each proceeding generation for hundreds of years.

So how does this relate in Canada?

Again, there is a slight difference between the official wording given to the citizenry and what actually happens in the event of a loved one passing. Officially, there is no inheritance tax. Great, right? Not quite.

If you pass and have an eligible beneficiary: spouse, common-law partner, child under 18, or a disabled child or grandchild of any age – you are more secure as long as they are listed clearly in a will. If they are not listed and an accident happens, taxes of up to 50% will be applied after the sale of your assets before the profits are divided up. Some assets still may be caught up within the system, but most should transfer with taxes deferred if a will is clearly defined. However, this is never as smooth as they make it sound as pensions can be cut, and assets held up when spouses or young children need the help most.

Where it becomes tricky is for those without an eligible beneficiary that would still like to keep their assets within the family or their inner circle to help build generational wealth. While there is said to be no inheritance tax in Canada outright, upon passing, all assets registered to the name of the deceased are taxed up to 50% as income under capital gains law. From there, the remainder can be passed down. So while it may not appear as if there is an inheritance tax, the current system sure acts like there is. Stocks, savings, bonds, land, and real estate – everything is registered within the system and will be subject to income taxes making it more difficult to build generational wealth; stopping you from passing down the same standard of living as you enjoyed.

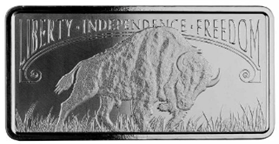

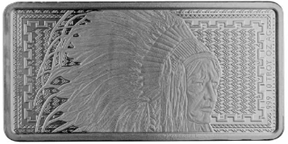

Silver and gold are the only true way to store liquid wealth and ensure it is passed down in its entirety, especially in a world where tracking assets has become far easier. There is no other asset on earth that once purchased grants its holder so much flexibility with how it can then be used. No one knows whether you gave your coins or bars as a gift to your children, buried them 6ft underground in your backyard for yourself, or lost them on a boating trip and dropped sunken treasure to the bottom of a lake for someone else to find. Only you know. This grants true power to the holder of these metals because as long as the person(s) you wish to pass them down to know exactly where they are in the event of an emergency, true wealth can be passed down through generation WITHOUT having even a small percentage taken.

Each individual works hard in his or her own way. Each individual deserves to truly preserve the economic energy they believe they are storing for themselves or for their loved ones. Precious metals ensure that for every family member that works and contributes to the whole, the pie will truly grow, and one day – your family may truly gain economic freedom.

By definition, Liberty means:

the state of being free within society from oppressive restrictions imposed by authority on one’s way of life, behaviour, or political views.

The key portion is, “the state of being free”. If you are not happy and free, what else is there? If you wish to secure your financial freedom, and mark it with pieces that represent liberty and freedom – follow the links below:

Hi,

Hi,