A Look Back at U.S. Government Debt

Several decades ago, many people experienced, or at least heard of, the tradition of grandparents buying government bonds for their grandchildren. Typically, the child would look confused at the gift, but after some laughter, the grandparent would explain that owning government debt is a safe bet. “It’s a sure thing!” they would say. This belief held true through most of the 1900s and into the 2000s. Although there were some economic challenges during this period, one thing remained constant: U.S. government debt was seen as the gold standard.

Shifting Realities of U.S. Debt

Today, things have changed. More people are starting to recognize the dangers of the practice of printing endless money and accumulating debt. This change in perspective extends beyond ordinary citizens to foreign governments and institutions, who used to eagerly buy U.S. debt during Treasury bond auctions. To clarify: when the economy is strong and demand for U.S. debt is high, bond yields decrease, meaning the bonds pay out less. However, when the economy weakens and demand drops, the bonds are sold at a premium, which raises yields to make them more attractive.

What Happens When Bonds Fail to Sell?

When the U.S. Treasury fails to sell all its available bonds, the unsold bonds go to a Primary Buyer. Historically, the Federal Reserve has been the buyer of last resort. As the central bank of the U.S., the Federal Reserve essentially buys the nation’s debt, which means that the U.S. is, in effect, purchasing its own debt. This creates a troubling situation because, when other countries and institutions buy debt through bonds, they are helping fund government spending. But when the Federal Reserve steps in, they do so by printing new dollars, flooding the market with currency that didn’t exist before. This leads to inflation, a pattern we saw during the massive stimulus efforts during the lockdowns. Currently, the Federal Reserve owns 18% of all U.S. Treasuries.

Rising Concern Over U.S. Treasury Auctions

Last Thursday, the U.S. Treasury hosted a 30-year bond auction. After all was said and done, Primary Buyers ended up purchasing 24.7% of all offered debt—more than double the average of 12% seen over the past year. This suggests growing global unease about the U.S. economy, raising doubts about the nation’s ability to meet its obligations. The value of U.S. dollars in circulation has once again come into question.

China’s Shift Away from U.S. Debt

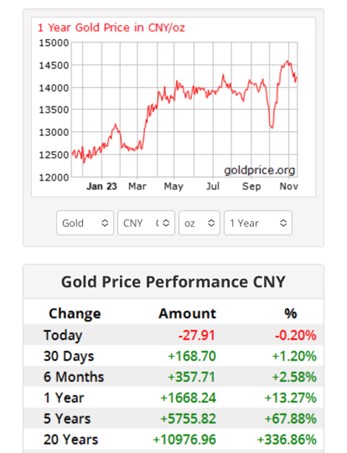

China, once one of the largest holders of U.S. debt, has reduced its holdings to a 14-year low. Instead, China is aggressively stockpiling gold, even though it is already the world’s leading gold producer. Reports indicate that the People’s Bank of China injected $1.45 trillion Yuan (about $200 billion USD) into its financial system, marking the largest such injection in nearly seven years. China now finds itself caught between a weakening economy, partly due to a sagging property market, and a struggling Yuan. Despite this, gold continues to offset the weakness in national fiat currencies. As seen in the charts, China’s unwavering focus on accumulating gold has paid off, with gold rising by 13.27% since November 2022. It has recovered from a dip in October and is pushing toward new all-time highs.

Japan’s Struggles and the Yen’s Decline

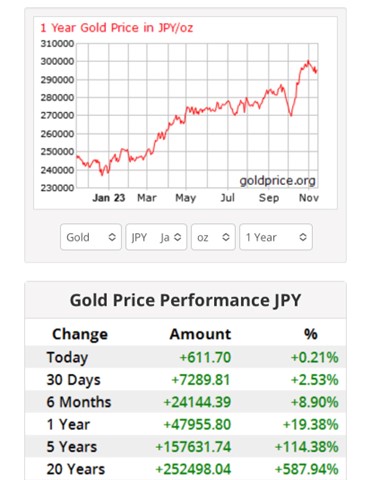

In Japan, the Yen is quietly becoming a major concern in global financial markets. A Bloomberg report showed that the Yen has fallen to its lowest level against the G-10 currencies since 2007, just before the Great Financial Crisis. As the Yen weakens, Japanese citizens are flocking to gold to protect their wealth. Since last November, gold has surged nearly 20% when measured in Yen, reaching new all-time highs. This trend shows no signs of stopping as Japan’s economic outlook continues to worsen.

The Future of the Global Financial System

It’s becoming increasingly clear that the global financial system is reaching a breaking point. A resolution is inevitable, and it will likely force us to reconsider the current system and rebuild. Hopefully, this time we will learn from our mistakes and restore gold and silver as the foundation of our monetary system, giving it real value. In the meantime, individuals must prepare for what lies ahead. As history has shown, wealth is not created or destroyed; it is simply transferred. Nations are buying more gold than ever, anticipating the shift from debt-based assets to value-based ones. Gold and silver remain the most reliable assets humanity has ever known.

Below, you will find sovereign 1-ounce silver coins, popular among silver owners for their assurance of coming from a trusted, reliable source.

2023 1 Oz Silver Britannia Tube

2023 1 Oz Silver Kangaroo Tube

2023 1 Oz Silver Philharmonic Tube

2023 1 Oz Silver Canadian Maple Tube

Tags: Gold accumulation

Hi,

Hi,