You may have heard the phrase “death by a thousand cuts”, and if you haven’t, on the financial side it simply refers to a government, institution, bank, or organization that was brought to collapse or crisis due to multiple poor economic factors adding up over time leading to their collapse. Unlike the opposite in which one major factor is the sole contributor of the reason an institution failed. In this newsletter however, we will not be looking at a single institution going up in flames due to a thousand cuts, but rather the overall global financial system as this past week you saw a rush of poor economic data come out, leading those in the economic sector to grow ever more concerned than they already were.

Earlier in the week, the Conference Board’s Index of leading economic indicators has now fallen and signaled a severe downturn for 19 straight months. The last streak of this magnitude that saw this specific index drop for 19 months straight, was between 2007 and 2009, with the Great Financial Crisis being lodged right in the middle of the previous streak. However, of course, we did not see a major recession or crisis in the financial system in 2007 when these indicators starting taking their downturn, instead we saw the collapse occur near the end of 2008. This is why these indicators are called “Leading Indicators” as they have an uncanny ability of sniffing out economic turmoil long into the future rather than highlighting what we are currently seeing at the time; and it is clear this is one major cut out of the one thousand the global financial system has already undergone.

As for the second of a thousand cuts we saw this past week, we turn our attention to look quickly at United States unemployment rates. Currently, we are seeing a little bit of number fudging by government officials that is leading citizens to believe the economy is stronger than in reality. As of time of writing, the United States has 6.5 million Americans currently unemployed. With there being an estimated 339,996,563 people in the United States that would suggest that 1.91% of Americans are currently out of work. However, when you consider that 99.9 million adult Americans are considered to be ‘not in the labour force’ and therefore not counted toward official unemployment, you see the number of adult Americans out of work skyrocket to 106.4 million; pushing unemployment to 26.6%… a staggering number. For context, this number did not get higher than 90 million between 2007 and 2009.

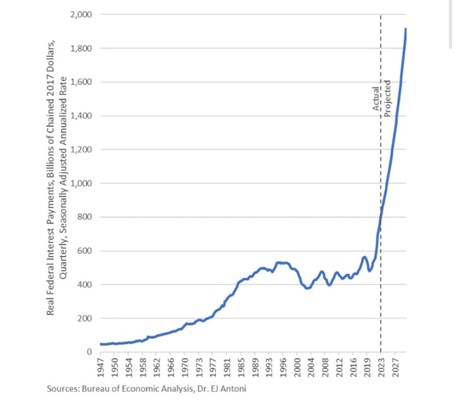

Continuing on with our final cut against the United States that was also reported this week takes us to the egregious amount of unfunded liabilities the United States government has promised. Quickly, what an unfunded liability refers to are programs like Social Security or Medicare that the government has promised to pay its citizens well into the future, with many relying on these payments for retirement. However, the major issue is that with the United States national debt ripping upward to over $33.75 trillion USD the government is in a pinch to try to pay this back, which seems like a large number until you realize that current unfunded liabilities sits at a WHOPPING $211.7 TRILLION USD. This means that the United States government has promised to pay citizens over 6x more than they already owe to repay their debt, which many consider to be unpayable… let alone a bill 6x higher!! There is simply no way citizens will receive the payments they were promised, and if they do, could you imagine how much currency would need to be created to pay each citizen, and then where that would leave the value of the currency they are paid off in. It truly is a mess as right now the United States is sending $1 trillion USD of personal income taxes directly to the Federal Reserve to pay off the interest on their massive debt number, which is a staggering 40% of all personal income tax receipts the government will receive for the ENTIRE YEAR. The United States is essentially broke and severely underwater, as you can see the chart below that highlights the projected interest payments the United States would owe as their national debt continues to climb at an accelerated pace.

Looking overseas at a major financial cut that was taken by China, you can see it becoming glaringly obvious why China has been the largest importer of gold over the past several years as their economy continues to slip aggressively due to a terrible property market. Zhongzhi Enterprise Group (ZEG), a leading wealth manager within China has told investors that it has become insolvent due to the country’s property debt crisis spilling over into the broader financial market. ZEG announced that it was insolvent due to having liabilities between 420-460 billion Yuan or $58-64 billion USD, while only having assets valued at 200 billion Yuan or just under $28 billion USD, meaning they owe more than double of what they own. So what did this mean for investors? It means ZEG had to apologize to investors due to them LOSING EVERYTHING that had been invested with ZEG. A frightening situation for those around the world, as even though it was mostly Chinese citizens with money invested with ZEG, if the same thing were to happen to a bank here in Canada or the United States as we have seen with Silicon Valley bank and others this year, smaller citizen investors get washed away and sucked into the whirlpool created by a collapsing financial behemoth.

It should come to NO surprise learning about these most recent reports that Chinese citizens have continued to load up on gold to protect themselves as property investments fail, with the same being said for their government. While in the West, you are beginning to see more and more people try to educate citizens on the power of precious metals during times of economic crisis. Also, if the 19 straight months of poor leading economic indicators is signalling anything, it is that 2024-25 very well may etch itself in the history books as one of the worst financial periods in human history as everything in the global financial sector has been bound with more and more risk since the Great Financial Crisis of 2008 which almost saw the world economy collapse at that time.

If you are looking to get out ahead and protect yourself before these poor economic indicators turn to obvious signs of trouble, there is no better time to do that than this weekend as here at Au Bullion we are offering incredible Black Friday sales that can be found below or on our website.

Hi,

Hi,