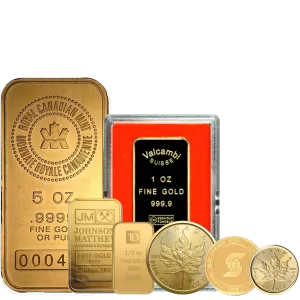

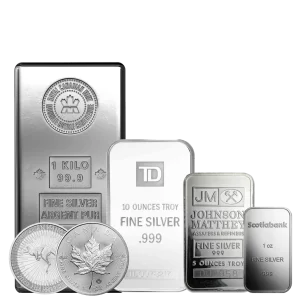

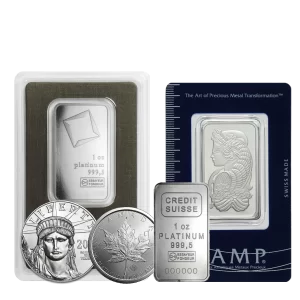

What is Precious Metals Bullion and Why is it a Good Investment? Bullion made of precious metals, such as gold, silver, platinum, and palladium, can add value to a portfolio of investments for several reasons. Diversification: Because precious metals frequently fluctuate independently of other asset classes like stocks and bonds, they can help diversify an…

Category: Gold

Why Investing in Gold is a Smart Way to Hedge Against Inflation?

What is Inflation and How Does it Impact Our Economy? A prolonged increase in the average price of goods and services over time is referred to as inflation. In other terms, inflation is the pace of decline in money’s ability to buy things over time. The economy is impacted by inflation in a multitude of…

Powell Comments Present Golden Buying Opportunity

Yesterday, Jerome Powell, Chairman of the Federal Reserve testified to the Senate Banking Committee that interest rates would need to go much higher than anticipated to quash an inflation rate that refuses to fall. This caused silver and gold to sell off on the market losing nearly 5% on the silver side, and nearly 2%…

Investing in Silver and Gold – Why You Should Buy from a Reputable Dealer

Precious metals like silver and gold are increasingly popular investments for those who want to diversify their portfolio, especially during times of economic uncertainty when people are looking to protect the purchasing power of their wealth. However, when you buy silver and gold, you will want to make sure or at the very least you…

Investing in Precious Metals: Finding the Right Bullion for You

Investing in precious metals is an attractive option to many investors looking to hedge against soaring global inflation due to the rapid currency printing taking place across the world. The right type of bullion and size of piece can maximize your investment potential and ensure that you get the best return on your money, while…

Hi,

Hi,